ESG (Environmental, Social, and Governance) is fast becoming one of the most important metrics by which investors, consumers, policymakers, and employees assess the obligations of businesses. The world has changed, and so have expectations of the private sector’s responsibility in the face of new and emerging issues—whether related to climate change, racial justice, or worker and consumer safety, among many others.

For many companies, this will mean reevaluating supply chains, reforming governance structures, and moving from paper to digital documents, among other activities. Insurers, for their part, are looking at these activities too.. In few industries are the incentives between the private sector and ESG best-practices as aligned as in insurance. ESG is more than just a “checking the box” exercise for insurers; the continued success—and in some cases, the continued survival—of the insurance industry depends on our collective ability to tackle the environmental, social, and governance issues of our time.

Insurers and climate risk

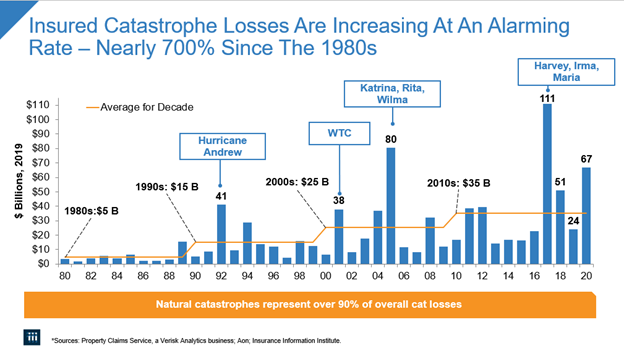

Perhaps the clearest example of the interconnectedness of insurers’ interests and society at large is climate change. There is no question that catastrophic natural events are becoming more common. Eight of the top ten costliest natural disasters in U.S. history came after the year 2000, with the other two coming in the 1990s. Average inflation-adjusted natural catastrophe losses rose from $5 billion annually in the 1980s to $35 billion each year in the 2010s. Overall losses from the 2020 Atlantic hurricane season alone totaled $43 billion, $26 billion of which were insured. Insured catastrophe losses for 2020 altogether totaled $67 billion.

As the country’s financial first responders, insurers are not just responsible for providing relief to the communities affected by natural disasters, but also for planning for the potential catastrophes to come. The long-term resilience of both the communities impacted by disasters and of the industry itself depend on preparedness and improved risk-mitigation. Insurance has been looking at climate risk for decades, but insurers understand they need to plan and be prepared for a future that can and will see even more evolution. Insurers are moving from the historic posture of “detecting and repairing” to a more innovative stance of “predicting and preventing” This trend is helping both society and the industry’s business interests.

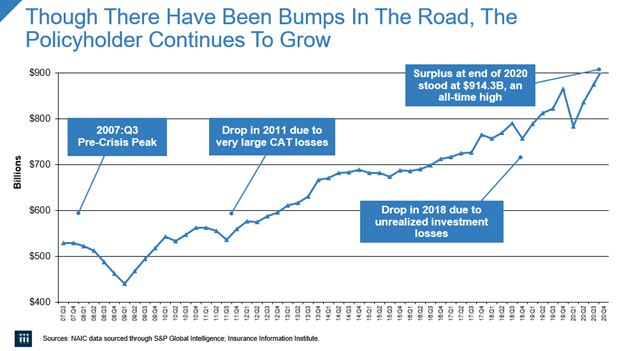

One way that insurers are preparing for this future is by keeping close eye on their policyholders’ surplus. It is the amount of money remaining after an insurer’s liabilities are subtracted from its assets and acts as a financial cushion above and beyond reserves, protecting policyholders against an unexpected or catastrophic situation. The industry’s resilience is demonstrated by the fact that even through times of severe stress, such as the 2007-2009 recession and the COVID-19 pandemic, the industry-wide policyholders’ surplus has not fallen below the $400 billion mark, the minimum base line set forth by regulators . The industry has continually been able to meet its financial obligations—in fact, the industry’s cumulative policyholders’ surplus reached an all-time high of $914.3 billion in 2020.

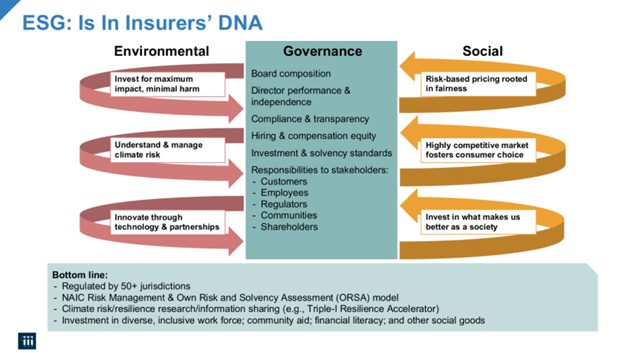

The bottom line — ESG is in insurers’ DNA

In many ways, ESG is in insurers’ DNA. While there is always room for improvement, the industry has long been focused on the three pillars of Environmental, Social, and Governance.

— Environmental: Insurers are investing in order to ensure they have the financial wherewithal to keep promises and pay claims as climate risks evolve, and using data and analytics to model risk and protect communities. Insurers simply could not be in business if they failed to pay attention to the changing landscape.

— Social: Insurers understand their unique position in society comes with added responsibilities. Close to three million Americans were employed by the insurance industry in 2019, with over $400 billion in claims paid that year alone. Insurers understand that fairness is a core expectation that stakeholders have of the industry, which is why they continually invest in making risk-based pricing models fairer and provide i consumers with premium relief when circumstances allow them to do so.. During the COVID-19 pandemic, for example, insurers provided over $14 billion in auto insurance premium relief to consumers as driving hours decreased. In addition, the industry has long supported non-profit organizations such as the Triple-I, the Insurance Institute for Business & Home Safety (IBHS), the Insurance Institute for Highway Safety (IIHS), and the Insurance Industry Charitable Foundation (IICF) to improve consumer safety and improve consumer understanding of insurance.

— Governance: Insurance is a highly-regulated industry. In the US, insurers are overseen by over 50 regulatory jurisdictions. In addition, they must regularly self-audit and submit assessments of their current and future risk to regulators through the Own Risk and Solvency Assessment. A collaborative, multi-stakeholder approach between insurers and state-based regulators is necessary to ensure the continued resilience of the industry.